Understanding the Cost of Doing Business

Are you a freelancer trying to navigate the financial landscape of your business? If so, you’re in the right place. In this blog post, we will explore the different types of costs you might encounter as a freelancer and why understanding these costs is crucial to your financial success. From software subscriptions and equipment to marketing and insurance, freelancers face a range of expenses that can impact their bottom line. But fear not, we will also provide practical tips on how to manage these costs effectively, helping you to build a more sustainable and profitable freelance business.

What Does ‘Cost of Doing Business’ Mean?

As a freelancer, you might be wondering, what exactly does ‘cost of doing business’ mean? Simply put, it refers to the total amount of money it takes to run your freelance business. These costs include everything from the money you spend on necessary equipment and software to the expenses incurred in marketing your services and acquiring new clients. Understanding your cost of doing business is vital as it directly impacts your profits and your pricing strategy.

The Different Categories of Business Costs

When it comes to business costs, not all are created equal. They can generally be broken down into four main categories: direct costs, indirect costs, fixed costs, and variable costs.

Direct costs are expenses that can be directly tied to your work, such as software subscriptions or project-specific expenses. On the other hand, indirect costs are expenses that support your business as a whole, such as marketing and insurance.

Costs can also be categorized as fixed or variable. Fixed costs remain the same regardless of your workload, such as rent or equipment costs. Variable costs, however, fluctuate based on the amount of work you do, such as travel expenses for client meetings. Understanding these different types of costs can help you better manage your finances and make informed decisions about pricing and profitability.

Direct Costs for Freelancers

As a freelancer, your direct costs are those that are tied directly to the work you do. These costs can vary widely depending on your field of expertise, but often include expenses related to software subscriptions, equipment, and project-specific requirements.

Software Subscriptions and Equipment

Many freelancers rely on various software tools to complete their work efficiently and effectively. Whether it’s a graphic design program, a project management tool, or a bookkeeping software, these subscriptions can add up quickly. Similarly, freelancers may need to invest in specific equipment, such as a high-quality laptop, a professional camera, or specialized hardware. It’s important to keep track of these costs and factor them into your pricing strategy.

Consider the following common examples:

- Adobe Creative Suite: This is a must-have for graphic designers and video editors. The cost can range from $20.99 to $52.99 per month depending on the specific applications you need.

- Microsoft Office 365: This suite of productivity tools, including Word, Excel, and PowerPoint, is essential for many freelancers. The cost is $6.99 to $9.99 per month.

- High-quality laptop: Depending on your needs, a suitable laptop could cost anywhere from $500 to $2000.

Project-Specific Expenses

For some freelancers, certain projects may require additional expenses. For example, a freelance photographer may need to rent specific equipment for a shoot, or a freelance writer may need to purchase books for research. These costs are directly tied to individual projects and should be factored into your project pricing.

Indirect Costs for Freelancers

Indirect costs are those that support your overall business operations but are not directly tied to a specific project. These costs include marketing expenses, professional development or training costs, and insurance premiums.

Marketing your services, for instance, is crucial for attracting new clients. This could involve costs for website hosting, advertising, or professional networking events. Similarly, investing in ongoing training can help you stay competitive and command higher rates. Insurance, meanwhile, is essential for protecting yourself from potential business risks.

Let’s take a look at some common direct and indirect costs in the table below:

| Direct Costs | Indirect Costs |

|---|---|

| Software subscriptions | Marketing expenses |

| Equipment | Training costs |

| Project-specific expenses | Insurance premiums |

Fixed and Variable Costs in Freelancing

When it comes to the cost of doing business, freelancers often encounter two types: fixed costs and variable costs. But what’s the difference between the two, and why does it matter?

Fixed costs are expenses that remain the same regardless of the number of projects you handle or the volume of your output. These costs are constant and need to be paid irrespective of your business activity. Examples of fixed costs for freelancers include rent or mortgage payments for your workspace, subscriptions to professional organizations, insurance premiums, and software subscriptions.

Variable costs, on the other hand, fluctuate based on the volume of work you do. These costs increase as your business grows and decrease when your workload is lighter. Variable costs for freelancers may include materials and supplies for specific projects, travel expenses related to client meetings, or outsourcing costs when you need to hire additional help on a project.

Understanding the difference between fixed and variable costs can help you predict your future expenses and plan your budget accordingly. It can also assist in making strategic decisions about scaling your business or taking on new projects.

How to Keep Track of Your Business Costs

Now that you understand the different types of business costs, it’s crucial to keep track of them effectively. Accurate tracking allows you to monitor the financial health of your business, plan for future expenses, assess the profitability of individual projects, and make necessary adjustments to your pricing strategy.

One way to keep track of your costs is by using accounting software. There are numerous accounting tools available that are designed for freelancers, offering features such as expense tracking, invoicing, and financial reporting. These tools can automate many aspects of financial management, saving you time and ensuring accuracy.

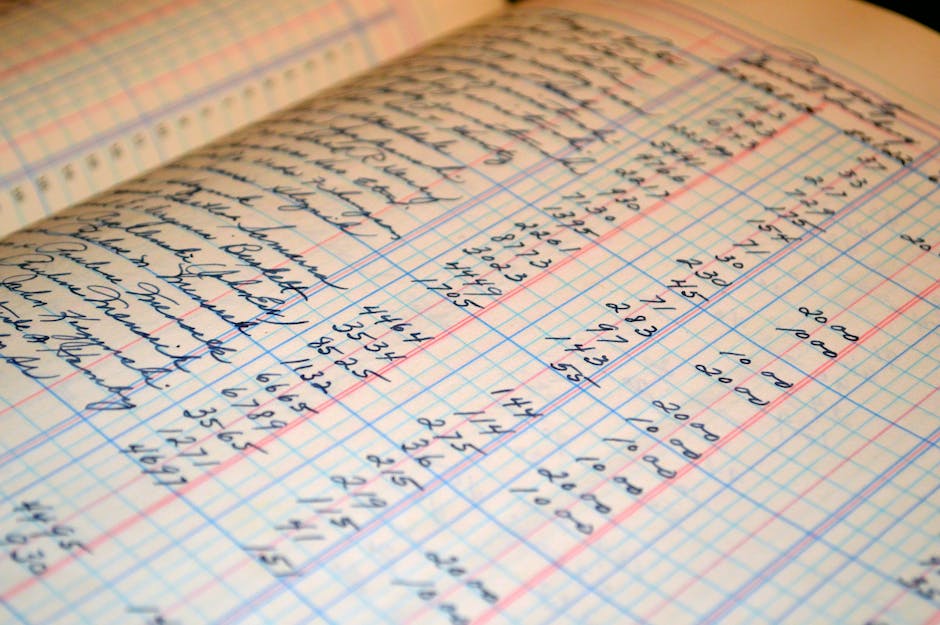

Another method is to use spreadsheets. While more manual than accounting software, spreadsheets offer flexibility and customization. You can create a system that works for your specific needs, tracking costs by project, client, or type of expense.

Lastly, consider using budgeting tools. These can help you plan for future expenses, set financial goals, and monitor your progress. By setting a budget, you can ensure that your spending aligns with your business objectives and prevent unexpected costs from derailing your financial plans.

- QuickBooks: An accounting software designed for small businesses, offering features such as expense tracking, invoicing, and financial reporting.

- Microsoft Excel: A powerful spreadsheet tool that can be customized to track costs by project, client, or type of expense.

- Mint: A budgeting app that allows you to set financial goals, track your progress, and plan for future expenses.

- Wave: A free accounting software that offers invoicing, expense tracking, and financial reporting.

- Google Sheets: An online spreadsheet tool that can be shared among team members for collaborative cost tracking.

- YNAB (You Need A Budget): A budgeting app that helps you plan for future expenses and align your spending with your business goals.

Strategies for Reducing Your Business Costs

Reducing your business costs is a critical step towards increasing your profitability as a freelancer. But how do you cut costs without compromising the quality of your work or your business growth? Here are a few practical strategies:

- Consolidate your software subscriptions: Evaluate your software needs carefully. If possible, opt for bundled packages that offer multiple services at a reduced cost.

- Invest in quality equipment: While this might seem counterintuitive, purchasing high-quality equipment can save you money in the long run as it tends to last longer and require fewer repairs.

- Take advantage of free training resources: There are plenty of free online resources available for freelancers to upgrade their skills. This can help you save on training costs.

- Optimize your marketing strategy: Focus on cost-effective marketing channels that have proven to be successful for your business. This could include social media marketing, content marketing, or word-of-mouth referrals.

How to Factor in Business Costs When Pricing Your Services

Setting the right price for your freelance services is crucial to ensure you’re earning a profit after accounting for your business costs. Here’s how to do it:

- Understand your costs: Have a clear understanding of both your direct and indirect costs. This forms the basis of your pricing strategy.

- Factor in a profit margin: Don’t just cover your costs, aim to earn a profit. This might require you to quote higher prices, but it’s necessary for the sustainability of your business.

- Consider market rates: Research what other freelancers in your industry are charging. This can provide a benchmark for your own pricing.

- Adjust for complexity and value: If a project is particularly complex or offers significant value to the client, don’t be afraid to charge more.

The Impact of Business Costs on Your Taxes

As a freelancer, your business costs have a direct impact on your tax obligations. In fact, many of these costs can be deducted from your taxable income, potentially reducing your overall tax liability. However, it’s important to keep accurate and detailed records of these expenses for tax purposes.

Some deductible expenses for freelancers include software subscriptions, equipment purchases, marketing costs, and even a portion of your home if it’s used as your primary place of business. However, tax laws can vary widely, so it’s always a good idea to consult with a tax professional to ensure you’re taking advantage of all possible deductions.

Remember, reducing your tax liability is another effective way to lower your overall business costs. So, don’t overlook the importance of good bookkeeping and tax planning in your freelance business.

Get Organized & Win More Clients

Kosmo has everything you need to run your freelancing business.