Invoicing Software for Startups

Let’s make invoicing a breeze and cash flow smoother! With Kosmo on your side, you can quickly send invoices, monitor payments, and effortlessly keep your financial game strong.

Invoicing for Startups with Kosmo

Streamlining invoicing for startups has never been easier, thanks to Kosmo’s cloud-based business management platform. Startups can take advantage of Kosmo’s comprehensive suite of tools designed to help them easily manage their administrative tasks, giving them more time to focus on growth and innovation. The sleek and user-friendly invoicing capabilities allow you to customize invoices with your startup’s branding and automatically add billable hours and expenses, ensuring accuracy and professionalism when billing your clients.

Kosmo’s invoicing feature integrates seamlessly with its other tools, such as expense tracking, project management, and payment processing, making it the perfect all-in-one solution for fast-paced startups. Additionally, ease your cash-flow worries by keeping track of overdue invoices and tasks, so you can maintain a healthy financial outlook as you navigate the exciting world of entrepreneurship. For a mere $9 per month, Kosmo’s platform is a must-have resource for startups looking to streamline their business management processes and keep their focus on what truly matters – building a successful enterprise.

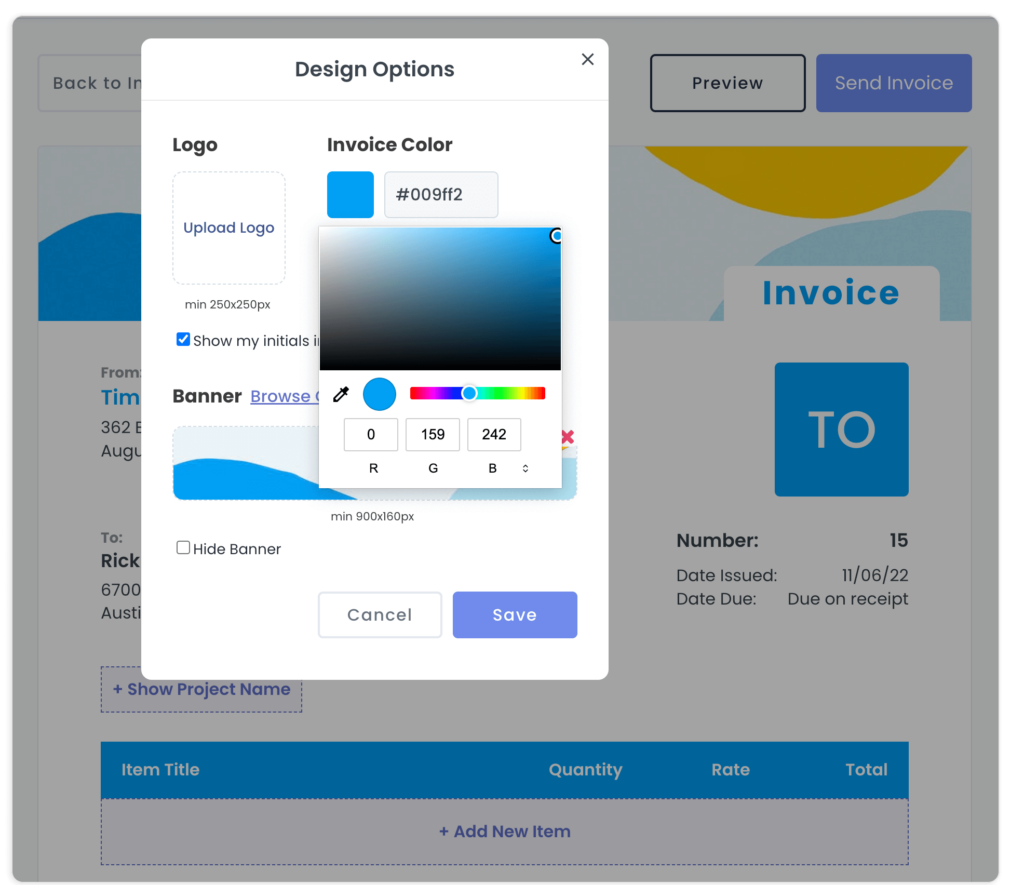

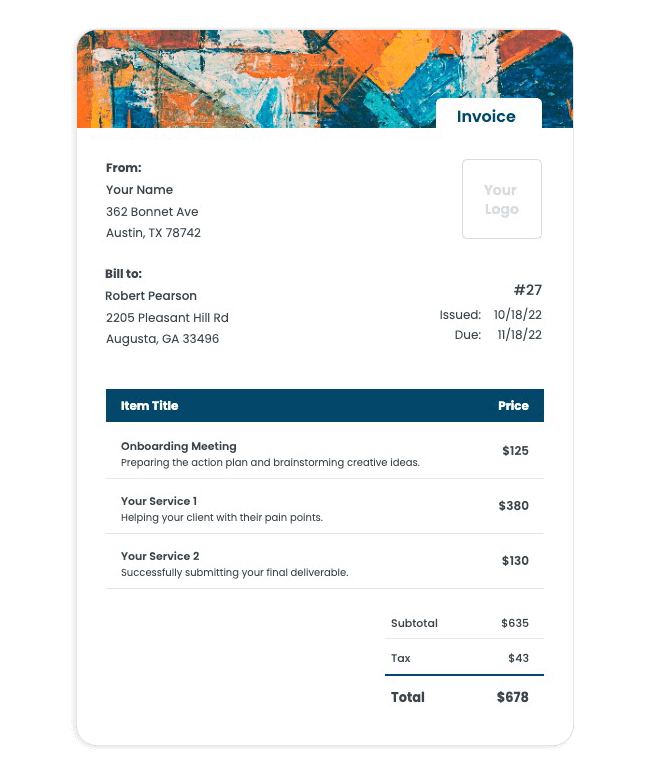

Create Professional Looking Invoices

Design invoices that match your brand and style. With Kosmo, you can customize your invoices with your logo, banner and colors.

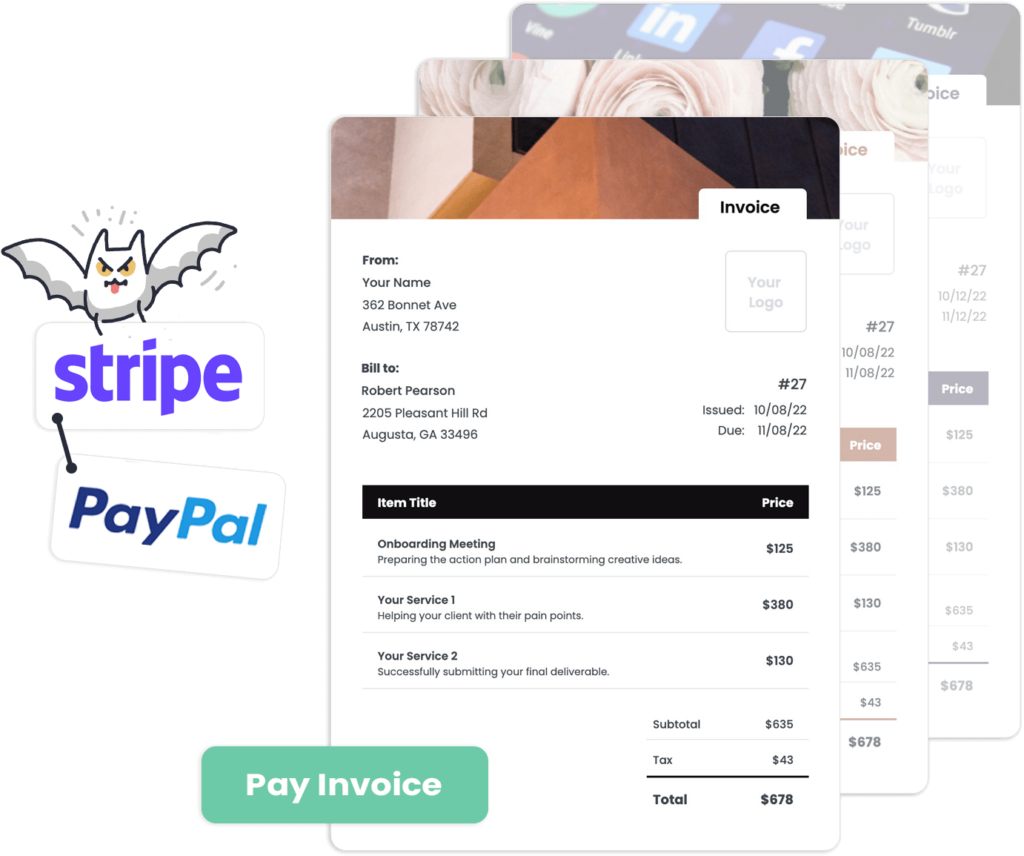

Get Paid Faster Via Credit Card and ACH

No more waiting for checks. Get paid via credit card and ACH. Kosmo also keeps track of all your payments in one place.

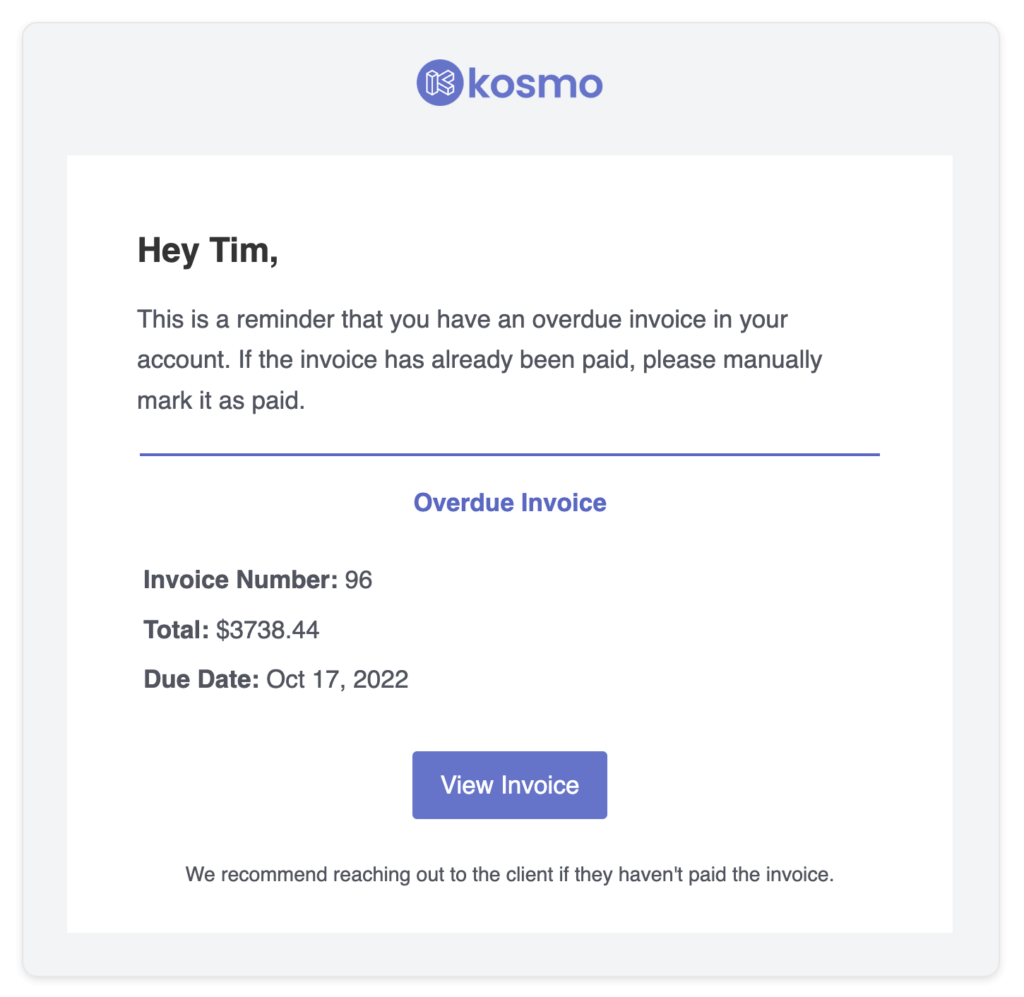

Never Forget About an Invoice

With automatic reminders, you’ll always know when a payment is due. Stay on top of your finances and get paid on time, every time.

Why Do Startups Need Invoicing Software?

Startups need invoicing software for several crucial reasons. First and foremost, invoicing software streamlines financial operations, providing a more efficient way to manage invoices and keep track of payments. This allows startups to save time and resources that could otherwise be spent on other important aspects of business development, such as customer acquisition or product innovation.

Additionally, invoicing software offers valuable features like customization of invoice templates, automated reminders for overdue payments, and integration with various accounting systems. These capabilities not only enhance a company’s professional image but also ensure accurate record keeping and improved cash flow management. By investing in invoicing software, startups can significantly reduce human errors, maintain proper financial documentation, and establish a foundation for sustainable growth.

What Are The Benefits?

Invoicing software offers numerous benefits to a startup, helping establish a streamlined financial process from the get-go. One of the primary advantages is the efficiency gained through automation. Invoicing software significantly reduces the time and effort required to generate, send, and track invoices. This enables entrepreneurs to focus their energy on growing their business rather than juggling paperwork and crunching numbers.

Another vital benefit for startups is adopting a professional image by using invoicing software. Customizable invoice templates allow businesses to maintain consistent branding across all client communications, while digital invoices with accurate information contribute to an image of reliability and trustworthiness. These features can enhance a startup’s reputation, which is crucial for attracting customers and retaining them in the long run.

Cash flow management is incredibly important for startups, and invoicing software assists with this aspect by providing real-time financial reporting. Detailed insights into outstanding invoices, payment statuses, and expenses help business owners stay informed about their company’s financial health. Additionally, the software allows for easy integration with other accounting tools, simplifying the process of tracking and managing all finances.

Invoice Templates

Want to know the secret of designing an invoice that ensures prompt payment for your startup? It’s a breeze with Kosmo to craft stunning, professional-grade invoices tailored to your freelancing needs.

Simply pick from our free invoice templates, infuse your unique brand identity, and don’t forget to add those crucial details – payment terms and contact info. Embrace the digital age by sending invoices online, and rest easy knowing that Kosmo’s got your back with automatic late payment reminders to speed up those payments.

Get paid on time,

every time.

Create professional invoices with Kosmo and level up your business today.

What payment options work with Kosmo?

Kosmo is designed to provide its users with the ease and flexibility needed to process payments efficiently. Stripe and PayPal are the two primary payment processors integrated into the platform, allowing for smooth transactions with credit and debit cards. This ensures that businesses can securely accept and manage payments, offering a seamless and convenient experience for their customers.

For those who prefer alternative payment methods, Kosmo also offers the ability to add custom payment options. This integration enhances the platform’s versatility, accommodating the specific needs and preferences of a diverse range of users, further optimizing the payment processing experience. Overall, Kosmo has your business covered with its broad support of payment options.

Does this really save time?

Invoicing software simplifies and streamlines the billing process for startups, saving valuable time that can be focused on growing the business. By automating the creation, sending, and tracking of invoices, these tools eliminate the need for manual data entry and reduce the risk of errors. Startups benefit from the ability to set up recurring invoices for clients on subscription or retainer-based services, ensuring consistent cash flow and accurate billing.

Additionally, invoicing software offers useful features such as payment reminders, customizable templates, and integration with other financial tools, which enable startups to maintain a professional image and keep their financial records organized. This comprehensive solution not only accelerates the payment process, but also assists startups in monitoring their finances, analyzing client payment patterns and generating insightful reports, making the overall management of their business more efficient.

Who should use invoicing software?

Invoicing software is designed to streamline billing processes, making it ideal for business owners, freelancers, and service providers. By automating invoice creation, tracking, and payment reminders, this software helps professionals save time, reduce errors, and maintain accurate financial records.

Small and medium-sized enterprises (SMEs) can particularly benefit from invoicing software, as it assists with managing cash flow and staying organized amid growth. Additionally, software with integrated features like expense tracking, time tracking, and customer relationship management tools can further enhance productivity. Ultimately, invoicing software is a valuable resource for any professional looking for an efficient, organized, and timely approach to maintaining their billing and payment processes.