Invoicing Software for Small Consulting Firms

Level up your invoicing game and get that cash flowing quickly. By using Kosmo, you’ll gain the power to whip up your invoices in no time, keep an eye on those payments, and master your financial management.

Invoicing for Small Consulting Firms with Kosmo

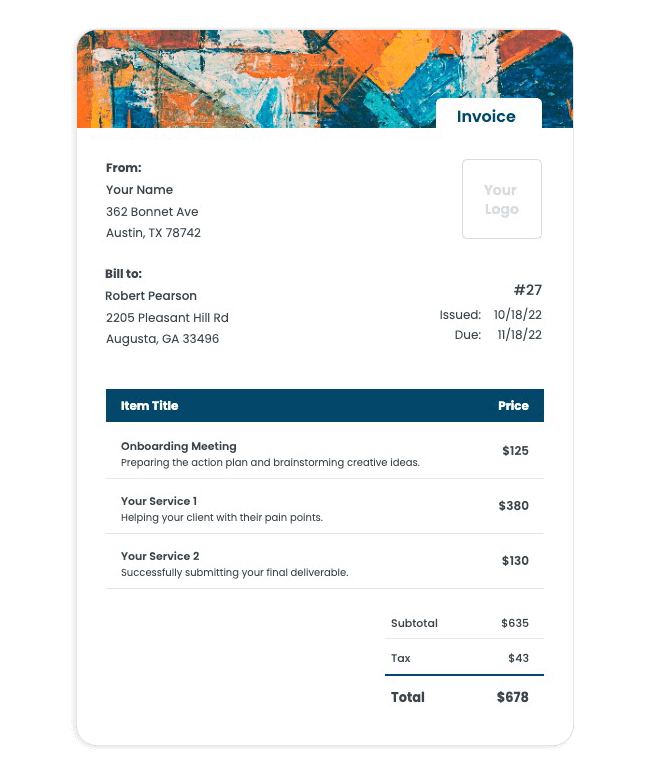

Managing finances effectively is crucial for success, especially for small consulting firms. Kosmo’s invoicing feature takes the stress out of invoicing and ensures a smooth process for both you and your clients. With the ability to customize invoices with your own branding and seamlessly add items, descriptions, and tracked time, you’ll create professional and accurate invoices that reflect your expertise and dedication to client satisfaction. Stay on top of your finances and maintain a consistent cash flow by taking advantage of Kosmo’s straightforward invoicing feature.

In addition to invoicing, Kosmo offers powerful tools specifically designed to simplify every aspect of your small consulting firm, from project management and client interaction to digital contract signing and payment processing. Don’t let tedious administrative tasks hold you back. Choose Kosmo as your all-in-one business management solution and refocus your valuable time on delivering top-tier consulting services to your clients. Unleash your full potential and watch your small consulting firm thrive with the assistance of Kosmo’s cloud-based platform.

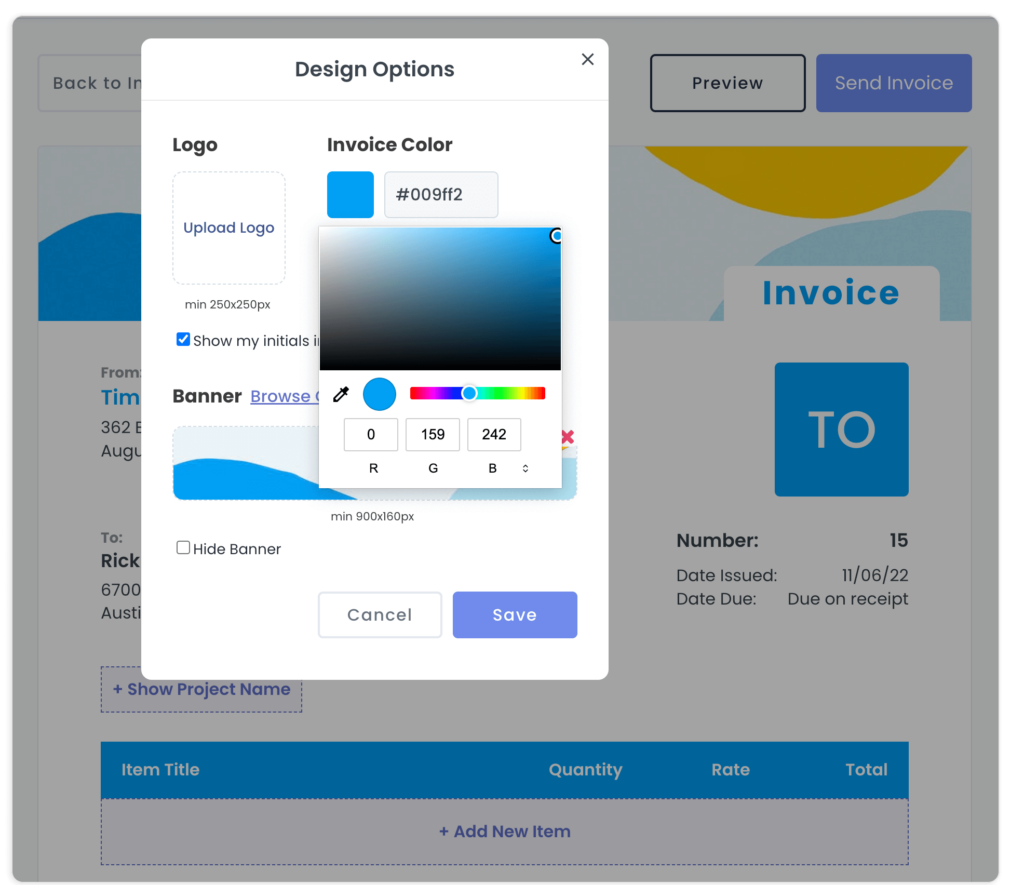

Create Professional Looking Invoices

Design invoices that match your brand and style. With Kosmo, you can customize your invoices with your logo, banner and colors.

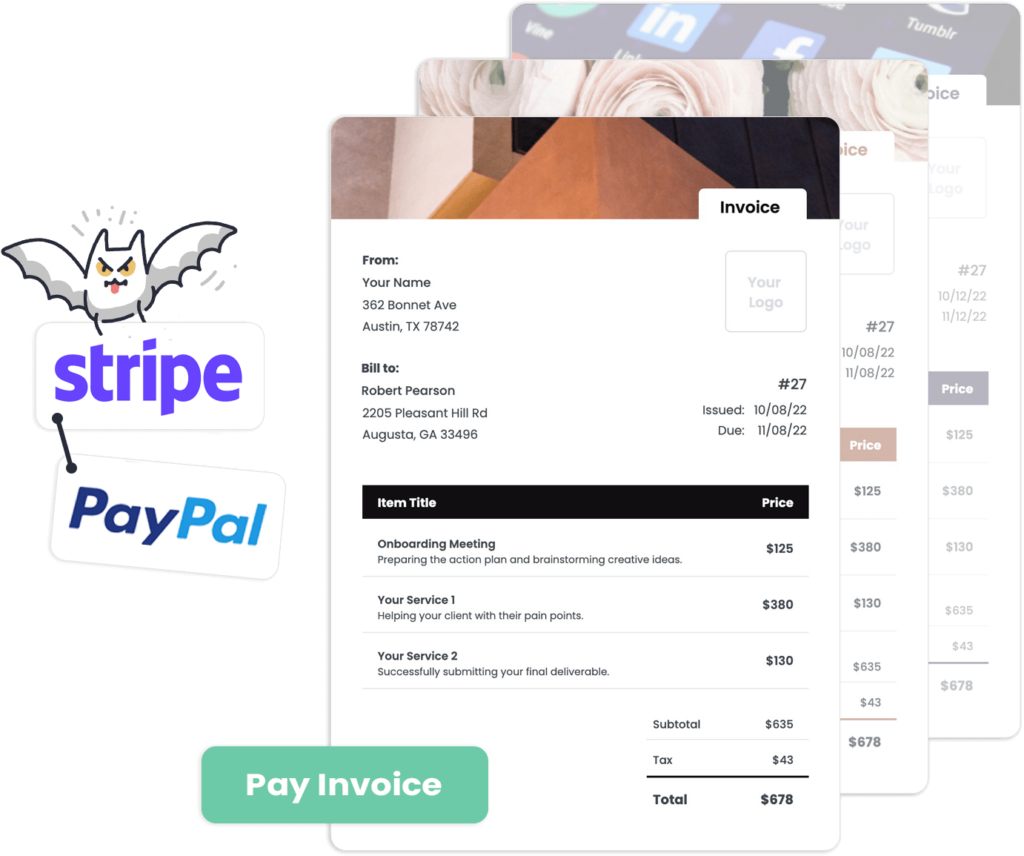

Get Paid Faster Via Credit Card and ACH

No more waiting for checks. Get paid via credit card and ACH. Kosmo also keeps track of all your payments in one place.

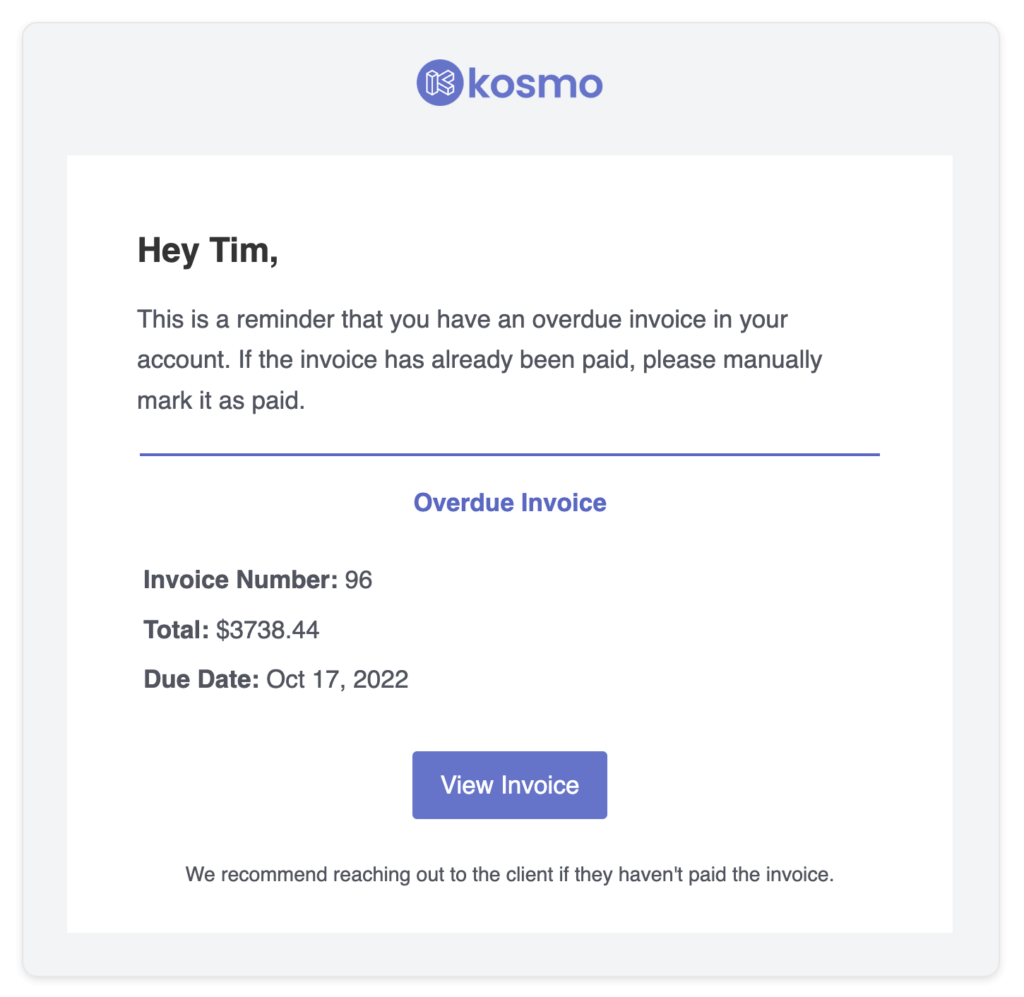

Never Forget About an Invoice

With automatic reminders, you’ll always know when a payment is due. Stay on top of your finances and get paid on time, every time.

Why Do Small Consulting Firms Need Invoicing Software?

Effective invoicing is crucial for small consulting firms, as it ensures they can maintain a positive cash flow and successfully manage their financials. Invoicing software simplifies this process by automating various aspects of invoicing, such as generating estimates, tracking expenses, and creating professional invoices. These benefits not only save time but also help avoid potential errors that could hinder progress or damage professional relationships with clients.

Additionally, invoicing software often comes with a variety of features designed to help small consulting firms stay organized and compliant. For instance, customizable templates allow firms to include essential elements such as company logo, payment terms, and applicable taxes. Plus, integration capabilities with accounting software streamline financial processes by synchronizing data and facilitating reporting. This seamless experience helps maintain accuracy and allows small consulting firms to focus on their core business functions.

What Are The Benefits?

Invoicing software is a powerful tool for small consulting firms, offering a multitude of benefits designed to streamline and improve financial processes. One of the most significant benefits is increased efficiency. By automating administrative tasks, such as invoice generation, payment tracking, and billing reminders, consulting firms can save both time and effort, allowing owners and employees to focus on projects and client relationships.

Another advantage of invoicing software for small consulting firms is improved cash flow management. With real-time insights into payment status and upcoming due dates, consulting firm owners can make more informed financial decisions, plan future investments more accurately, and reduce the time spent on manual tracking of receivables. Moreover, invoicing software often includes customizable templates, making it simple to maintain a professional and consistent brand image on all billing communications.

Lastly, invoicing software promotes better data organization and accessibility. By having all invoicing and payment information stored in a central location, small consulting firms can easily generate insightful financial reports to evaluate their business performance and make data-driven adjustments when necessary. Additionally, cloud-based invoicing solutions offer enhanced security measures and remote access to important financial data, making it easier for business owners to collaborate with team members and stay informed anywhere, at any time.

Invoice Templates

Ever wondered how to make an invoice that ensures timely payment for your small consulting firm? With Kosmo, crafting attractive, professional invoices for your services is a breeze!

Just pick one of our complimentary invoice templates, personalize it with your unique branding, and fill in crucial details such as payment terms and contact info. By sending your invoices online, you’ll speed up the payment process and benefit from automatic late payment reminders. Small consulting firms, rejoice!

Get paid on time,

every time.

Create professional invoices with Kosmo and level up your business today.

What payment options work with Kosmo?

Kosmo, an innovative platform for business management, offers a variety of payment options that provide convenience and security to both users and their customers. With the integration of well-established payment processors such as Stripe and PayPal, accepting payments has never been easier.

Supporting an array of credit and debit cards, Kosmo ensures smooth transactions for a hassle-free online shopping experience. Additionally, users can add custom payment options to accommodate their customers’ preferences and facilitate seamless transactions. This adaptability truly sets Kosmo apart as a versatile payment solution tailored to the needs of modern businesses.

Does this really save time?

Invoicing software streamlines the billing process and enhances time management for small consulting firms by automating manual tasks. With features such as customizable invoice templates, automatic calculations, and integrated payment processing, professionals can create, send, and track invoices efficiently. This allows them to focus on serving their clients and growing their business, instead of spending valuable time on administrative duties.

Additionally, invoicing software ensures that small consulting firms maintain organized records and improve client communications. The software enables consultants to effortlessly manage client information, keep track of projects, set up recurring billing, and send payment reminders. In turn, this facilitates a more effective cash flow management while reducing the risk of human error and providing a seamless billing experience for clients.

Who should use invoicing software?

Invoicing software can be a game-changer for a variety of businesses and professionals who need a more efficient, organized, and user-friendly way to manage their billing processes. Freelancers, small business owners, and large enterprises alike can benefit from adopting an invoicing software solution.

Freelancers such as consultants, designers, writers, and photographers often deal with multiple clients and projects. Implementing invoicing software can help them streamline their billing tasks, reducing the time spent on manual invoice creation and tracking payment statuses. Small businesses, particularly those with diverse product offerings or a growing customer base, can use invoicing software to maintain better control over revenue streams, outstanding payments, and client information. Lastly, even large enterprises can benefit from the automation and reporting features that come with invoicing software, as it fosters improved communication and collaboration between departments, and helps identify potential bottlenecks or areas for improvement.