Invoicing Software for Mortgage Brokers

Boost your mortgage brokering business by efficiently managing your finances. With Kosmo, you can effortlessly send invoices in no time, keep track of payments, and stay ahead in the monetary game.

Invoicing for Mortgage Brokers with Kosmo

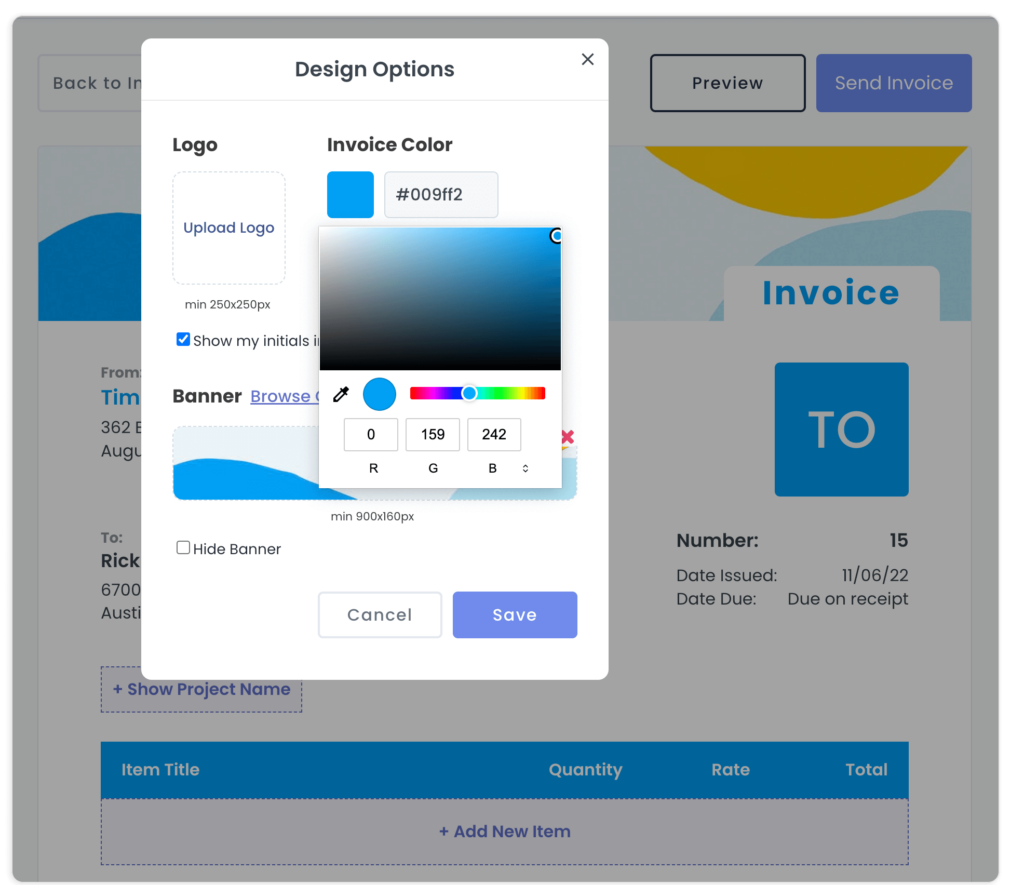

Kosmo offers an exceptional invoicing solution specifically tailored to meet the needs of mortgage brokers. By streamlining the invoicing process, this cloud-based platform saves you valuable time, enabling you to concentrate on what truly matters: offering top-notch service to your clients. With just a few clicks, you can customize your invoices with your logo and banner, add item descriptions, and efficiently track time spent on tasks — all while giving your clients a professional and cohesive experience.

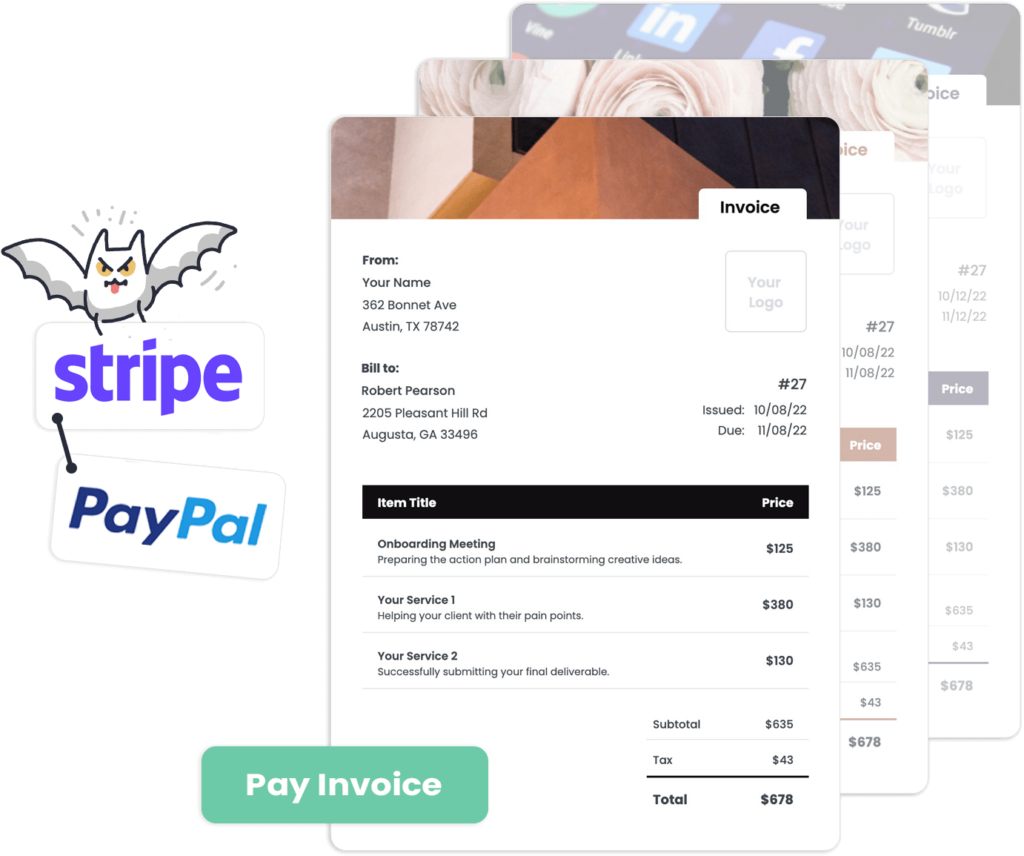

Moreover, with the seamless expense tracking feature, it becomes incredibly easy for mortgage brokers to manage their finances and monitor project-related spending. Kosmo’s proposal and contract management tools, paired with digital client signatures and log files, provide an added layer of transparency and security in your client communications. This robust invoicing solution, combined with its integration with Stripe and PayPal, makes Kosmo the go-to platform for mortgage brokers seeking effective business management.

Create Professional Looking Invoices

Design invoices that match your brand and style. With Kosmo, you can customize your invoices with your logo, banner and colors.

Get Paid Faster Via Credit Card and ACH

No more waiting for checks. Get paid via credit card and ACH. Kosmo also keeps track of all your payments in one place.

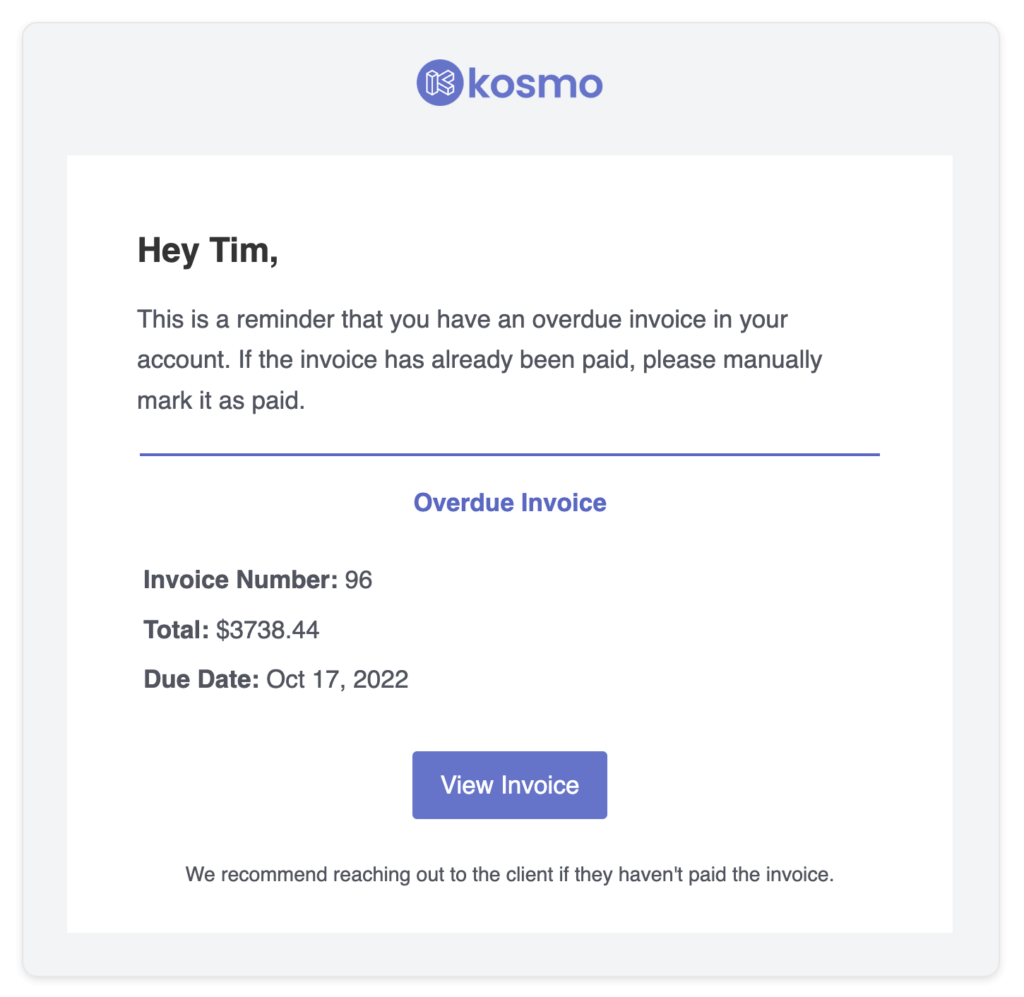

Never Forget About an Invoice

With automatic reminders, you’ll always know when a payment is due. Stay on top of your finances and get paid on time, every time.

Why Do Mortgage Brokers Need Invoicing Software?

Mortgage brokers require invoicing software to streamline the billing process, enhancing efficiency and professionalism. This software automates the creation, sending, and tracking of invoices, eliminating the need for manual input and reducing errors. Efficient tracking of payments helps mortgage brokers maintain healthy cash flow, ultimately improving their financial stability. Moreover, invoicing software keeps the entire billing process organized, making it easy to manage taxes and maintain financial records, ensuring regulatory compliance.

In addition to these financial benefits, invoicing software can enhance mortgage brokers’ client relationships. Customizable templates allow brokers to create professionally branded invoices, reflecting their commitment to quality service. Furthermore, the software often includes features for online payments and reminders, which make it more convenient for clients to fulfill their obligations. By improving the overall invoicing experience, mortgage brokers can foster customer satisfaction and trust, leading to long-term business growth.

What Are The Benefits?

Invoicing software offers numerous advantages for mortgage brokers, streamlining their operations and enhancing overall efficiency. One of the primary benefits is the ability to automate repetitive tasks. Mortgage brokers can save time by eliminating manual processes associated with creating, sending, and tracking invoices. Automation not only improves accuracy but also ensures timely payments by offering customizable payment reminders.

Another significant benefit for mortgage brokers using invoicing software is its ability to support multiple payment gateways. As a mortgage broker, you may have clients from different countries or prefer various payment methods. Invoicing software allows the integration of multiple payment gateways, providing a hassle-free solution for your clients to make their payments. By offering a seamless payment experience, you can increase their satisfaction and improve your chances of receiving payments promptly.

Additionally, invoicing software helps mortgage brokers to maintain accurate financial records. The software typically offers detailed reporting and analytics features, providing real-time insights into your cash flow, expenses, and profits. This valuable data can help you make informed financial decisions and enhance your overall business performance. Moreover, the efficient record-keeping capabilities of these tools simultaneously assist in meeting compliance requirements and making tax filing more straightforward.

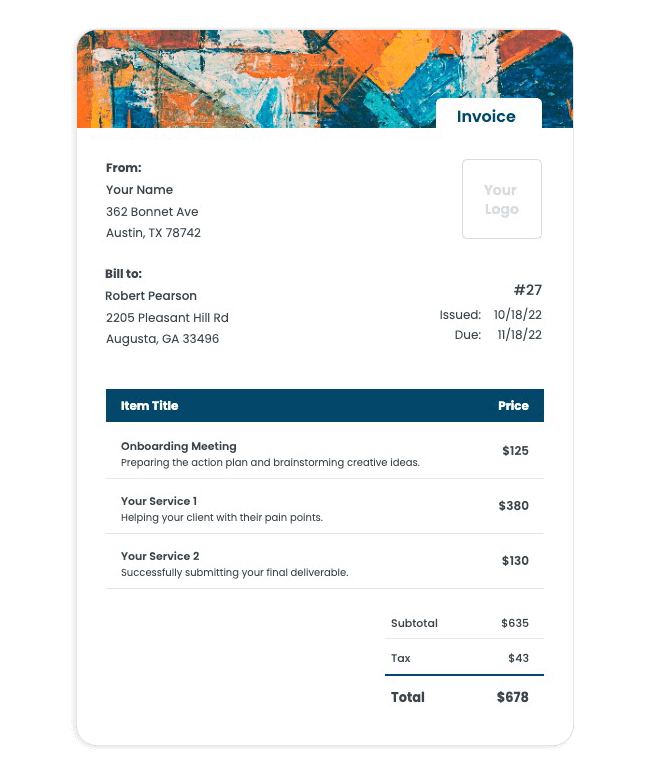

Invoice Templates

Wondering how to craft an invoice for your mortgage broker services that will get you paid promptly? Kosmo makes generating elegant, professional invoices for your work as simple as 1-2-3.

Pick from our extensive range of complimentary mortgage broker invoice templates, personalize it with your brand image, and add all the crucial information like your payment conditions and contact details. Transmit your invoice digitally, and earn money speedier with automated overdue payment notice.

Get paid on time,

every time.

Create professional invoices with Kosmo and level up your business today.

What payment options work with Kosmo?

Kosmo offers users a variety of payment options designed to meet their diverse needs. They can easily process payments through well-known platforms such as Stripe and PayPal. These platforms accommodate a range of payment methods, including credit and debit cards, ensuring a seamless experience for customers.

Additionally, Kosmo allows users to add custom payment options, providing them with the flexibility to integrate other payment methods that may be particularly relevant to their business or customers. This enables users not only to simplify their transactions but also to cater to their clients’ preferences, leading to a more satisfying user experience.

Does this really save time?

Invoicing software can significantly save time for mortgage brokers by automating the tedious tasks associated with billing and payment management. Paperwork becomes a breeze, as customized invoice templates can easily be created, tailored to reflect the broker’s brand, and then sent to clients electronically. By reducing paperwork, mortgage brokers can spend more time focusing on client acquisition, cultivating relationships, and closing deals.

Another major benefit of invoicing software is the improved organization and accuracy in managing financial transactions. The software streamlines the tracking of payments, ensuring real-time visibility of incoming funds and outstanding invoices. With a user-friendly dashboard, mortgage brokers can effortlessly monitor their cash flow, reducing the chances of errors or misinterpretations. Additionally, many invoicing tools offer integrations with accounting software, conveniently syncing all financial data, ultimately simplifying the entire process and allowing mortgage brokers to invest their time more productively in growing their businesses.

Who should use invoicing software?

Invoicing software is a valuable tool for a wide range of businesses and individuals who want to streamline their billing processes, save time, and present a professional appearance to clients. This includes freelancers, small business owners, and larger organizations with extensive client lists and complex billing requirements.

Freelancers and small business owners benefit from invoicing software as it simplifies the process of creating and tracking invoices while ensuring accuracy and consistency. It also helps them manage cash flow, allowing them to focus on delivering high-quality products and services to their clients. On the other hand, larger organizations will appreciate the ability to automate recurring invoices, manage multiple currencies, and generate financial reports that aid in strategic decision-making. Overall, invoicing software assists anyone looking to optimize their billing process, increase efficiency, and instill confidence in their clients.