Invoicing Software for Financial Planners

Say goodbye to invoicing headaches and hello to quicker payments with Kosmo. This nifty app enables financial planners like you to effortlessly send invoices, track payments and ultimately manage your finances with ease.

Invoicing for Financial Planners with Kosmo

Keeping track of your finances and invoicing just got a whole lot easier for financial planners! Kosmo’s user-friendly platform provides you with the ability to streamline your administrative tasks and ensure client satisfaction every step of the way. Say goodbye to tedious, time-consuming processes and manual invoicing – Kosmo offers an all-in-one solution for financial planners who need to maximize their efficiency and focus on providing top-notch services to their clients.

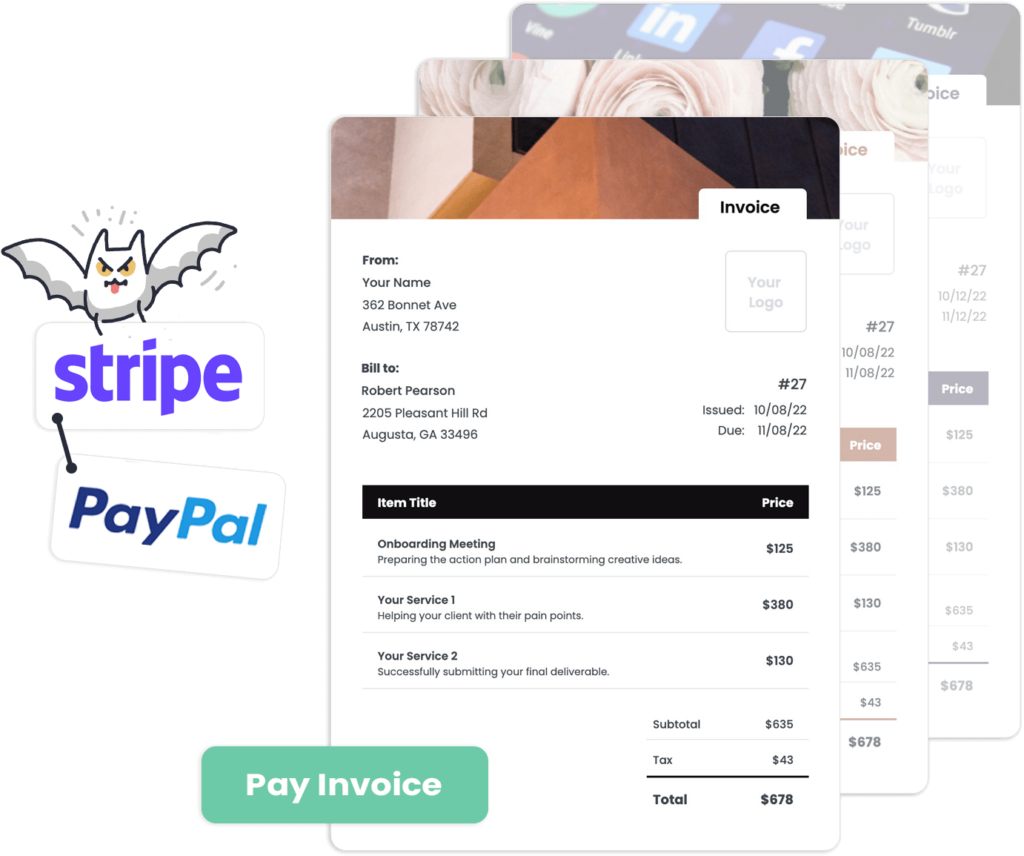

Managing invoicing for financial planners is a breeze with Kosmo. Its customizable invoicing system allows you to create professional-looking invoices tailored to your business’s branding. With the ability to track your tasks, time spent on projects, and expenses, you’ll be able to generate detailed invoices that accurately reflect the hard work you put in for your clients. In addition, Kosmo’s integration with Stripe and PayPal payment processing means you can effortlessly receive payments, while the platform keeps an eye on any overdue tasks and invoices, ensuring you stay on top of your workload and maintain a thriving, well-organized financial planning practice.

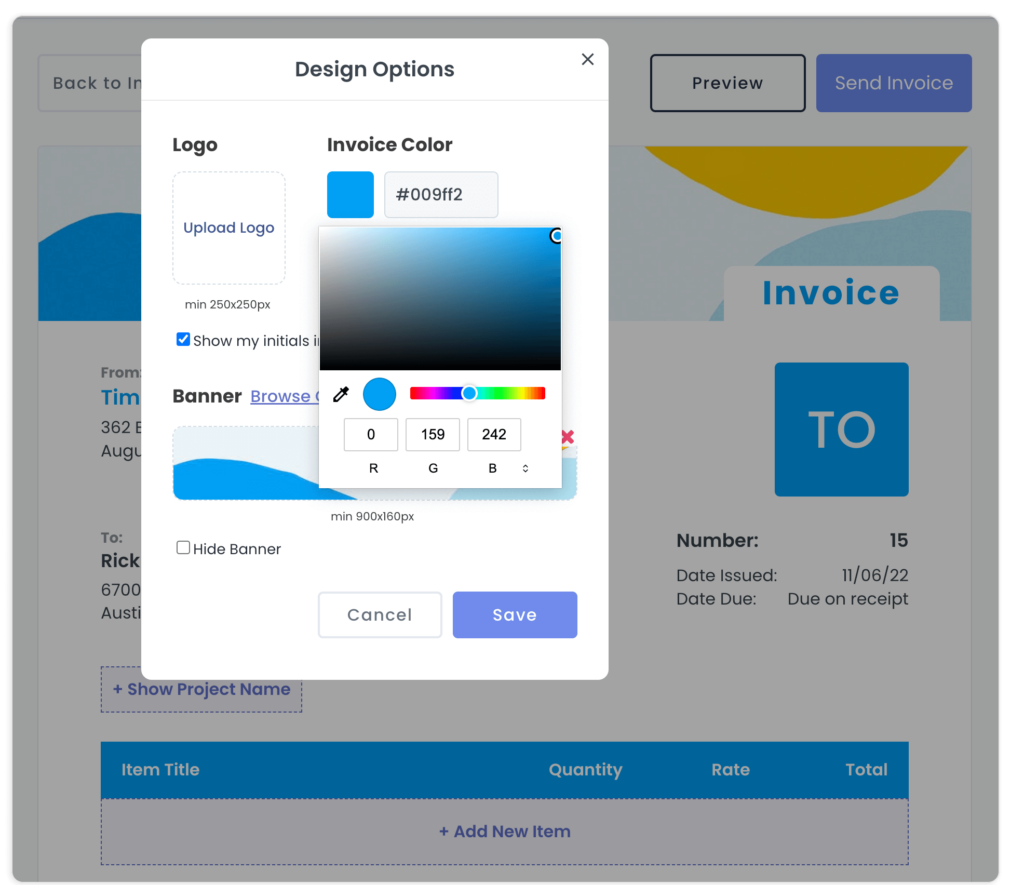

Create Professional Looking Invoices

Design invoices that match your brand and style. With Kosmo, you can customize your invoices with your logo, banner and colors.

Get Paid Faster Via Credit Card and ACH

No more waiting for checks. Get paid via credit card and ACH. Kosmo also keeps track of all your payments in one place.

Never Forget About an Invoice

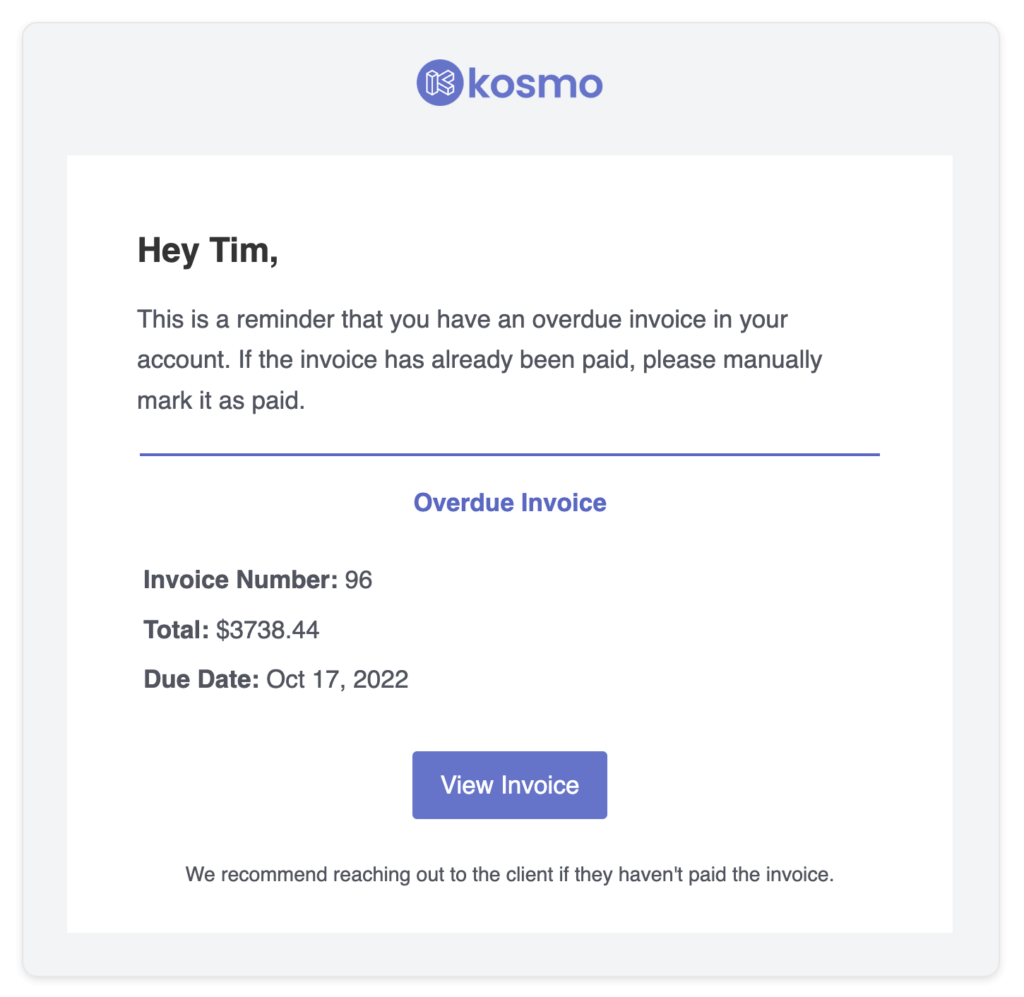

With automatic reminders, you’ll always know when a payment is due. Stay on top of your finances and get paid on time, every time.

Why Do Financial Planners Need Invoicing Software?

Invoicing software is essential for financial planners because it streamlines the billing process and enhances client relationships. With an invoicing system in place, financial planners can create professional, customized invoices that include important details, such as client name, services provided, fees, and payment terms. By automating this process, financial planners can save time and reduce the risk of errors, which can lead to misunderstandings with their clients.

Furthermore, invoicing software provides valuable insights into a financial planner’s business performance. These systems often come with built-in reporting tools that enable users to track income, outstanding payments, and client payment history. By making data-driven decisions, financial planners can identify areas for improvement and ensure they maintain a healthy cash flow, allowing them to focus on providing high-quality financial planning services.

What Are The Benefits?

Efficient invoicing is crucial for financial planners, as it streamlines cash flow and enhances client relationships. Investing in invoicing software can offer numerous benefits that go beyond simply generating invoices.

One key advantage is the automation of recurring processes, such as sending out monthly invoices and following up for payments. Automated invoicing reduces the risk of errors, as well as saves time and effort by eliminating manual data entry. As a result, financial planners can allocate their resources to more pressing tasks, like providing excellent financial advice to clients.

Invoicing software also provides features that foster professionalism and enhance the financial planner’s credibility. Customizing invoices with company branding and including detailed service breakdowns not only improve the client’s perception of the business, but also contribute to increased transparency. Moreover, most invoicing platforms integrate with popular accounting software, which allows financial planners to effortlessly track invoicing and payment status. This integration leads to improved financial management and enables financial planners to make informed decisions based on accurate data.

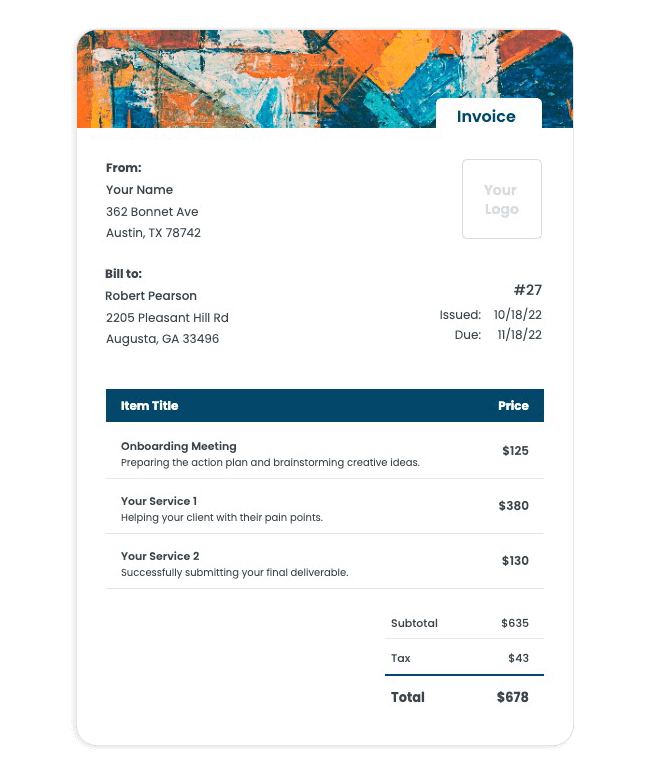

Invoice Templates

Looking for a way to create a standout invoice for your financial planning services? Look no further than Kosmo, where crafting stunning, professional invoices is a breeze.

Just pick a free invoice template from our collection, customize it with your branding, and input all the crucial details like contact information and payment terms. By sending your invoice online, you’ll not only speed things up but also benefit from automatic late payment reminders to ensure timely payment.

Get paid on time,

every time.

Create professional invoices with Kosmo and level up your business today.

What payment options work with Kosmo?

Kosmo offers a seamless payment experience for its users by providing a variety of payment options. The platform supports two widely popular payment solutions – Stripe and PayPal. By integrating these services, users can effortlessly process payments using credit and debit cards, ensuring a smooth transaction experience for both customers and businesses alike.

Apart from the predefined options, Kosmo also allows users to add custom payment methods to suit their specific needs. This flexibility makes it a great choice for businesses that need to cater to diverse payment preferences, which ultimately leads to better customer satisfaction and increased sales opportunities.

Does this really save time?

Invoicing software streamlines the billing process for financial planners by automating and simplifying crucial tasks. One way it achieves this is through customizable invoice templates, which eliminates the need to create invoices from scratch every time a new client is onboarded. These templates ensure a consistent and professional look, while also incorporating essential information such as client details, services rendered, and payment terms.

Furthermore, invoicing software provides financial planners with tools to manage client data efficiently. By storing client information in a centralized system, the software makes it easy to track payment histories, send payment reminders, and receive instant notifications when invoices are paid. This reduces manual work, minimizes errors, and allows financial planners to focus on their core responsibilities instead of spending time on administrative tasks.

Who should use invoicing software?

Invoicing software can be a game-changer for a variety of businesses and professionals, streamlining the process of billing clients, tracking finances, and ensuring timely payment. For small business owners and freelancers, using this software can save valuable time, helping them focus on their core services and client relationships instead of managing complex spreadsheets and manual billing processes. In addition, invoicing software keeps their financial records organized, minimizing errors, and providing an easy way to track outstanding invoices.

It’s not just small businesses that can benefit from invoicing software. Large companies dealing with multiple clients and projects can use these tools for simplified invoice management, ensuring all transactions and business records are up to date and accurate. The scalability of invoicing software makes it an ideal solution for growing businesses, providing a centralized platform for monitoring cash flow and generating customizable reports for decision-making and forecasting. In summary, any business or professional who wants to improve their payment tracking, reduce administrative tasks, and enhance financial reporting should consider using invoicing software.