Invoicing Software for Financial Analysts

Speed up your cash flow as a financial analyst with Kosmo’s simple invoicing system. Whip out invoices in a flash, monitor your payment status, and be the master of your financial world.

Invoicing for Financial Analysts with Kosmo

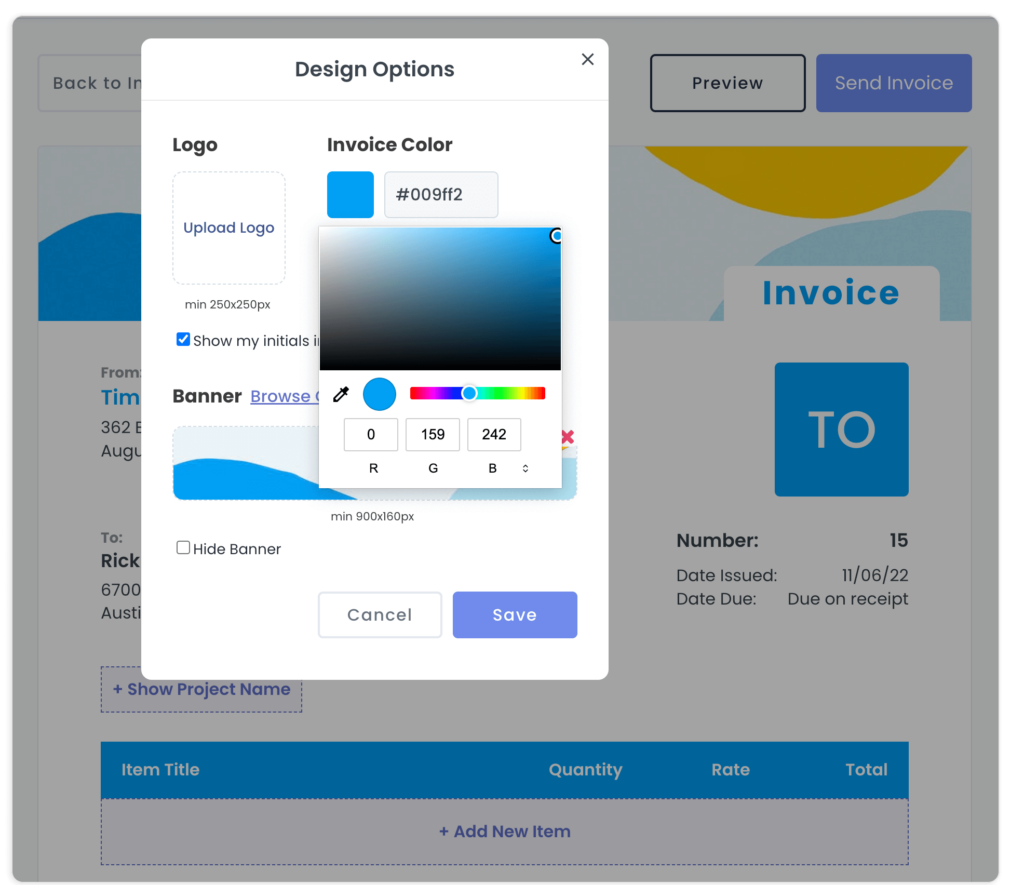

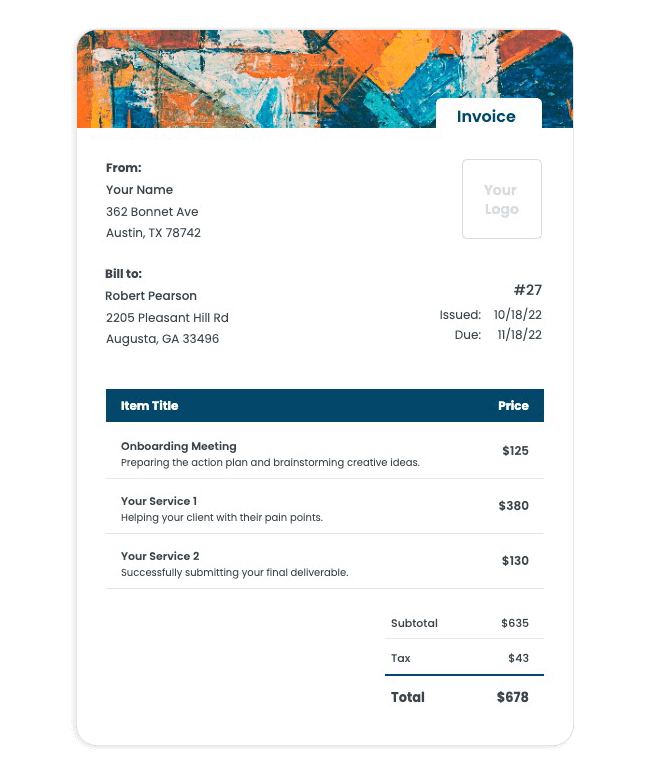

Managing invoicing for Financial Analysts has never been easier, thanks to Kosmo’s cloud-based business management platform. Say goodbye to manual calculations and lost invoices, as this powerful tool streamlines your administrative tasks and helps you focus on delivering top-notch financial analysis to your clients. With customizable invoicing templates featuring your own logo and banner, you can effortlessly create professional-looking invoices that accurately capture your projects’ billable hours and expenses.

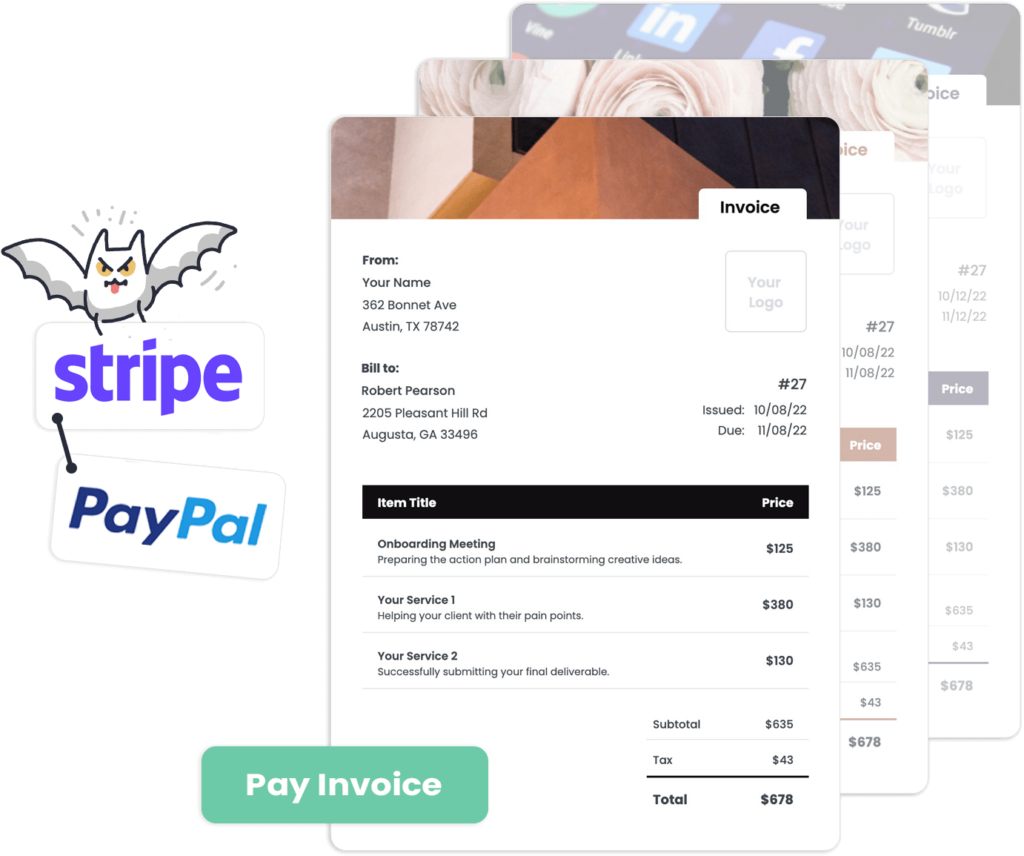

Kosmo goes beyond simple invoicing by offering a suite of tools specifically designed for Financial Analysts who want to manage their business efficiently. Effortlessly keep track of important client information, manage proposals and contracts, and monitor your expenses, all while ensuring timely payments through seamless Stripe and PayPal integration. With Kosmo’s intuitive project management capabilities, you’ll complete projects on time and impress your clients with your back-office efficiency, allowing you to focus on what you do best: providing exceptional financial analysis and insight. Invest in Kosmo for just $9 per month and revolutionize your invoicing experience today.

Create Professional Looking Invoices

Design invoices that match your brand and style. With Kosmo, you can customize your invoices with your logo, banner and colors.

Get Paid Faster Via Credit Card and ACH

No more waiting for checks. Get paid via credit card and ACH. Kosmo also keeps track of all your payments in one place.

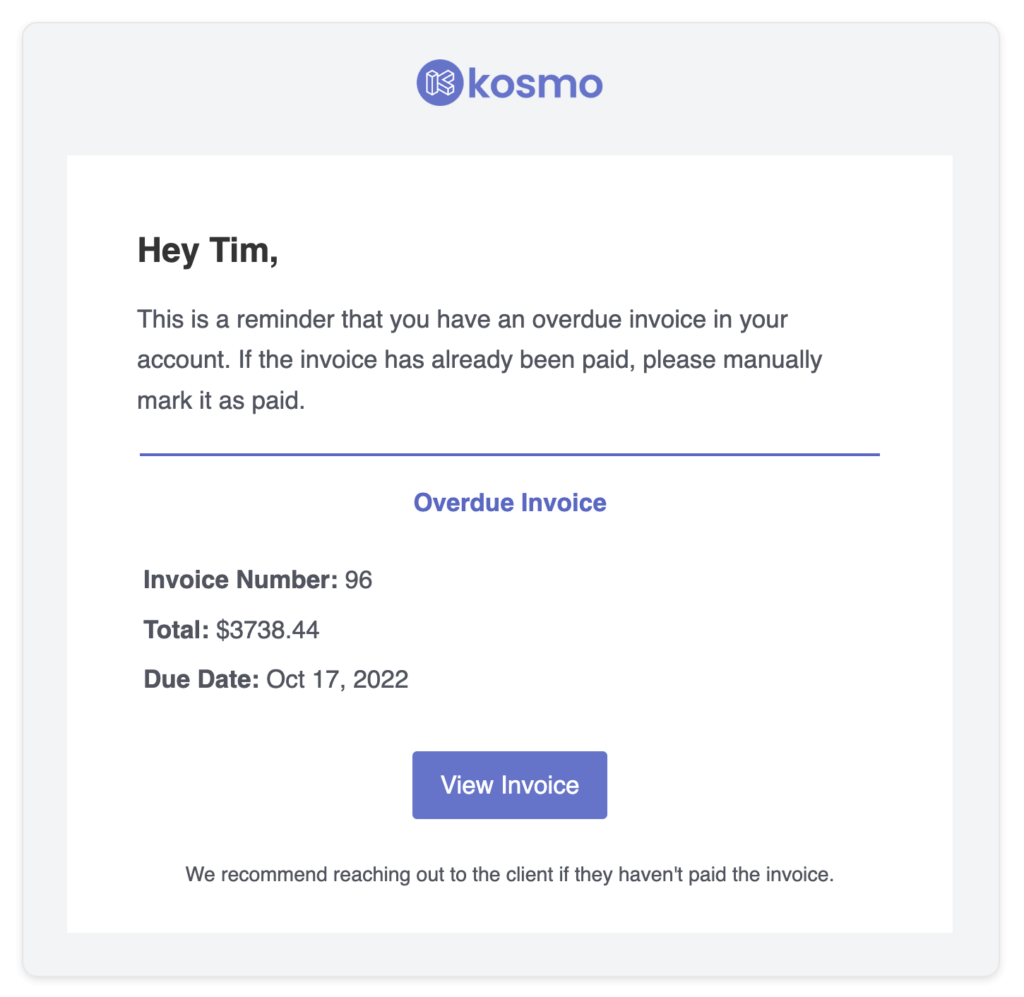

Never Forget About an Invoice

With automatic reminders, you’ll always know when a payment is due. Stay on top of your finances and get paid on time, every time.

Why Do Financial Analysts Need Invoicing Software?

Invoicing software plays a crucial role in the day-to-day operations of financial analysts, primarily by streamlining their billing processes and reducing the likelihood of human errors. As professionals who deal with vast amounts of data and financial transactions on a daily basis, leveraging invoicing software enables them to automate the creation and tracking of invoices while maintaining a standardized format. This results in significant time savings, allowing financial analysts to focus on more value-added tasks, such as in-depth analysis and providing actionable insights to clients.

Additionally, invoicing software provides a centralized platform for financial analysts to manage and monitor incoming and outgoing payments, as well as maintaining an updated record of client accounts. This level of oversight facilitates improved cash flow management and fosters proactive communication with clients regarding outstanding balances. Moreover, invoicing software often includes robust reporting capabilities, empowering financial analysts to analyze patterns in payment histories and generate tailored financial reports with ease, ultimately contributing to a more efficient and accurate decision-making process.

What Are The Benefits?

Invoicing software can be a game-changer for Financial Analysts, streamlining their invoicing processes and enhancing productivity. One significant benefit is the automation of repetitive tasks, such as creating invoices, tracking payments, and managing reminders. This reduces human errors and saves valuable time, enabling financial analysts to focus on critical initiatives and business strategies.

Another advantage of invoicing software is the integration with various financial tools and systems. Compatibility with bookkeeping and accounting software, CRM platforms, and payment gateways simplifies the workflow for financial analysts and ensures consistency and accuracy in data management. Real-time financial data analysis becomes easier, providing financial analysts valuable insights to make data-driven decisions.

Lastly, invoicing software offers customization options, which allows financial analysts to create brand-consistent invoices, improving their organization’s professional image. Features like multi-currency and multi-language support, tax calculations, and customizable templates provide greater flexibility and adaptability to suit the specific needs of the financial analyst, fostering a positive and efficient client service experience.

Invoice Templates

Wondering how to make an invoice that ensures you get paid for your financial analyst services? Look no further, as Kosmo makes creating sleek and professional invoices a breeze!

Just pick one of our complimentary invoice templates, customize it with your own branding, and input must-have details like payment terms and contact info. By sending your invoice through Kosmo, not only will you speed up the payment process, but you’ll also benefit from timely late payment reminders. Easy peasy!

Get paid on time,

every time.

Create professional invoices with Kosmo and level up your business today.

What payment options work with Kosmo?

Kosmo is designed to integrate with popular payment options for a seamless experience, supporting both Stripe and PayPal for processing payments. This means users can easily accept and manage payments made through credit and debit cards, giving customers the flexibility to choose their preferred method when making a purchase.

In addition to Stripe and PayPal, Kosmo also allows for the incorporation of custom payment options. This ensures that businesses with unique or industry-specific requirements are catered for, making the platform adaptable and user-friendly.

Does this really save time?

Invoicing software streamlines the invoicing process for financial analysts, allowing them to focus on their core responsibilities while ensuring accuracy and timely payments. By automating repetitive tasks such as data entry, invoice generation, and tracking of payments, financial analysts can save valuable time and reduce the risk of errors.

Additionally, invoicing software offers advanced features such as customizable invoice templates, real-time reporting, and integrations with accounting software, which allow financial analysts to have greater control and visibility over their client billing and financial transactions. These tools contribute to improved cash flow management, more efficient client communication, and faster decision-making.

Who should use invoicing software?

Invoicing software is a valuable tool for a diverse range of professionals and businesses. One group that can greatly benefit from this software are freelancers and self-employed individuals who need to manage multiple clients and projects. With invoicing software, they can quickly generate professional invoices, track outstanding payments, and maintain an organized system for their finances.

Small- to medium-sized businesses can also optimize their invoicing process using invoicing software. This system streamlines payment tracking and helps monitor the overall financial health of the business. Automating invoicing allows business owners to focus more on essential tasks, such as growing their operations, nurturing client relationships, and enhancing product/service offerings. Plus, built-in integrations with various accounting modules can ease tax season stress and improve financial reporting accuracy.