Invoicing Software for CPA Firms

Time to up your invoicing game and watch the cash flow in quicker! With Kosmo, your CPA firm can easily send out invoices in a snap, keep tabs on payments, and maintain a solid grasp on those precious finances.

Invoicing for CPA Firms with Kosmo

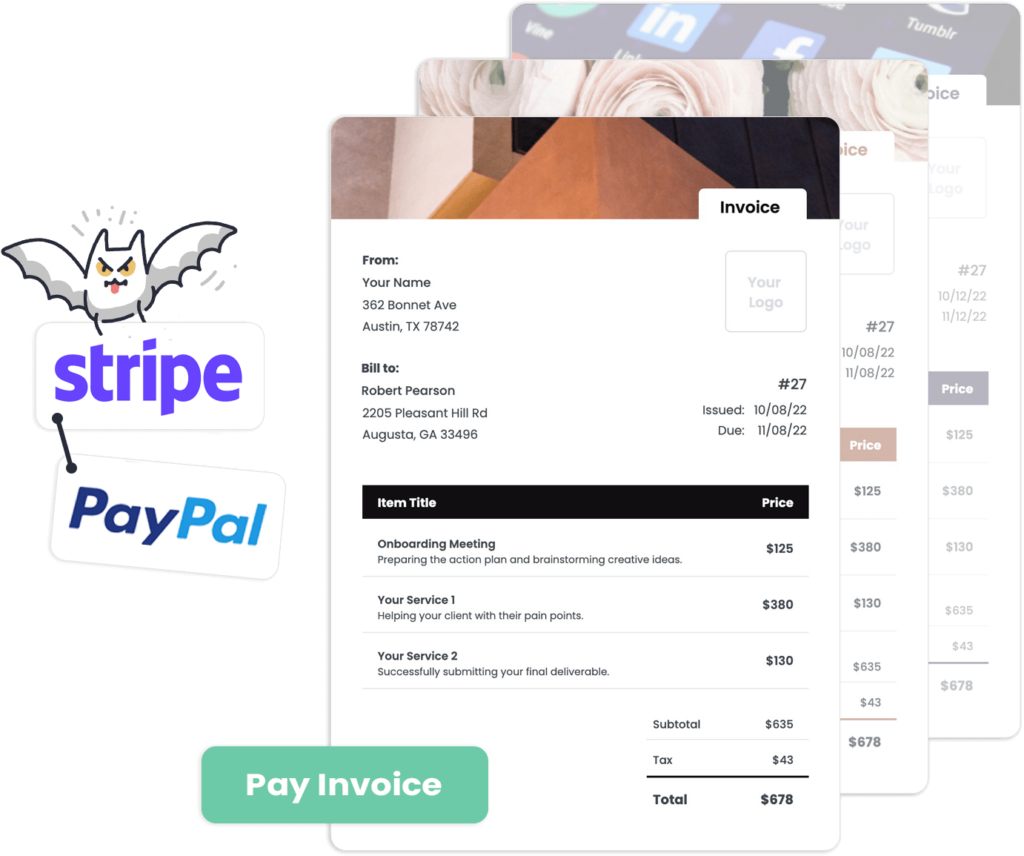

Streamlining invoicing processes for CPA firms can be a game-changer, and Kosmo is here to help. With its intuitive and user-friendly invoicing capabilities, Kosmo allows CPA firms to quickly create customized, professional invoices that align with their brand identity. Adding items, descriptions, and automatically incorporating tracked time is a breeze, ensuring accurate and easy-to-understand invoices for your clients. Plus, by fully integrating with Stripe and PayPal, getting paid promptly is no longer a worry, leaving more time to focus on providing top-notch financial services.

But wait, there’s more to Kosmo than just invoicing! CPA firms can take advantage of the platform’s comprehensive suite of tools to revolutionize their entire business management experience. Efficiently manage client relationships, track expenses assigned to unique projects, and stay on top of overdue tasks and invoices. Additionally, with Kosmo’s digital proposals, contracts, and log files, keeping crucial communications and agreements organized has never been so easy. At just $9 per month, Kosmo is the cost-effective, all-in-one solution your CPA firm needs to thrive.

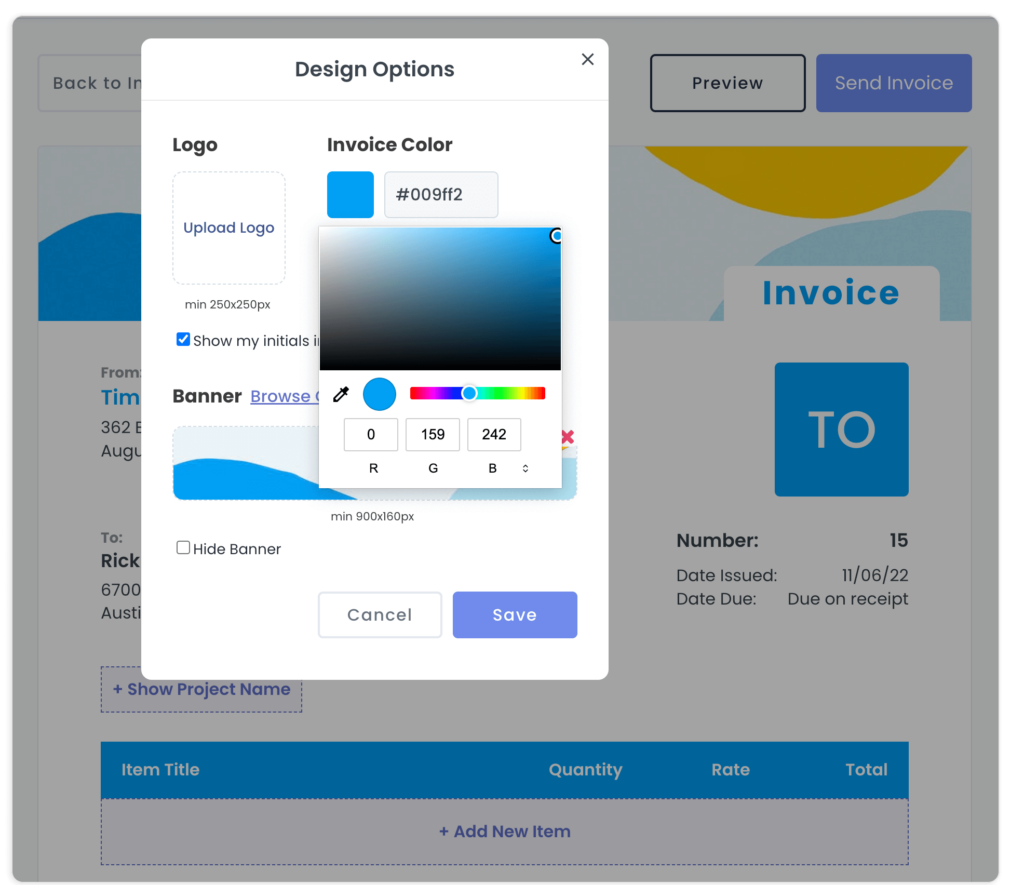

Create Professional Looking Invoices

Design invoices that match your brand and style. With Kosmo, you can customize your invoices with your logo, banner and colors.

Get Paid Faster Via Credit Card and ACH

No more waiting for checks. Get paid via credit card and ACH. Kosmo also keeps track of all your payments in one place.

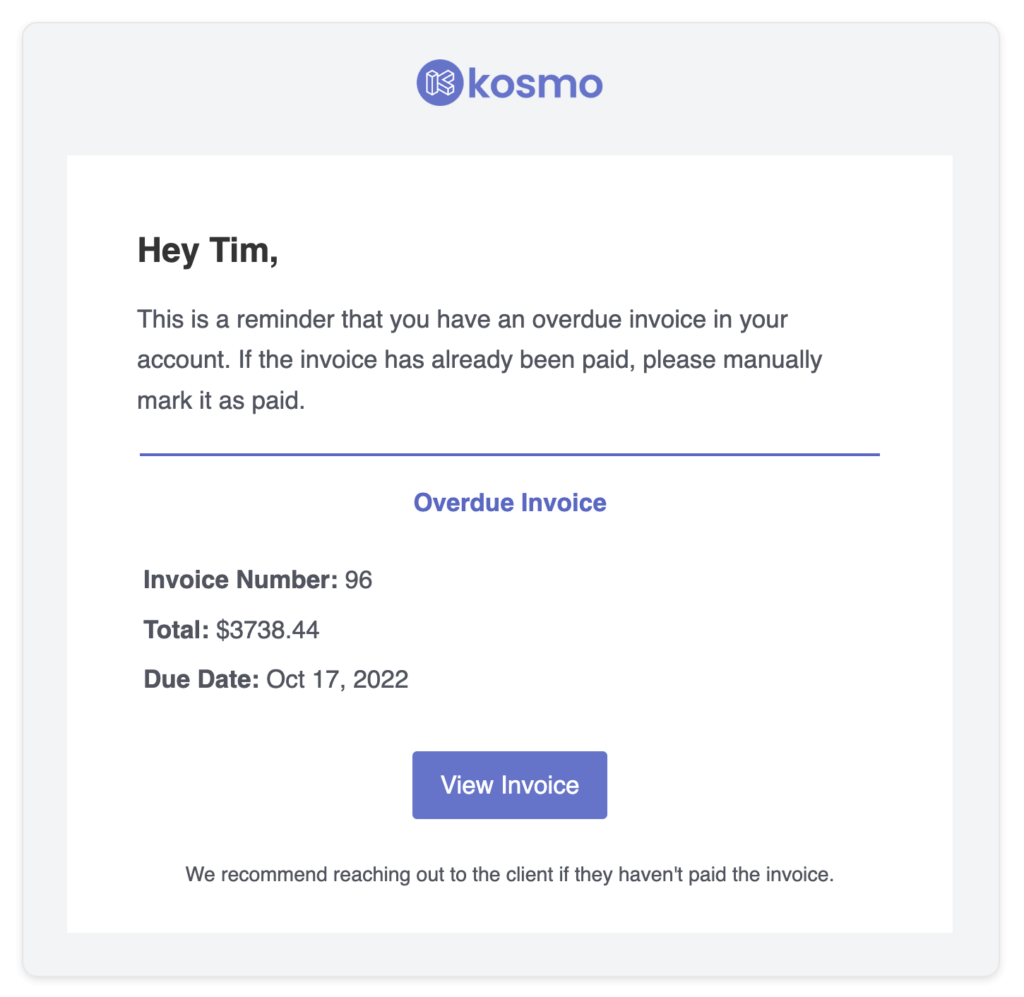

Never Forget About an Invoice

With automatic reminders, you’ll always know when a payment is due. Stay on top of your finances and get paid on time, every time.

Why Do CPA Firms Need Invoicing Software?

Invoicing software is essential for CPA firms for a multitude of reasons, primarily to optimize operational efficiency. By automating the invoicing process, it minimizes potential errors and saves time in tracking billable hours, expenses, and invoice generation. The customizable templates and streamlined system offered by modern invoicing software increase productivity, allowing CPA firms to focus on providing exceptional services to their clients rather than dealing with administrative tasks.

Additionally, invoicing software delivers a professional appearance and enhances client satisfaction through user-friendly designs, payment options, and swift communication. These features are critical to maintaining a positive image and ensuring timely payments. Furthermore, invoicing software helps CPA firms to monitor their cash flow effectively, as they can quickly analyze outstanding invoices and manage receivables. In summary, investing in invoicing software is vital for CPA firms to enhance productivity, client satisfaction, and financial management.

What Are The Benefits?

Invoicing software provides a range of benefits for CPA firms, streamlining operations and improving overall efficiency. One significant advantage is the reduction of manual tasks associated with traditional invoicing. By automating invoice creation, distribution, and tracking, CPA firms can save time and effort while minimizing the risk of human error. This allows professionals to focus on their core services, such as tax preparation and financial planning, without worrying about the administrative burden of billing.

Another benefit is the enhanced cash flow management invoicing software offers. With built-in features like payment reminders and the ability to process online payments, CPA firms can encourage faster payment from clients. Additionally, this software often provides comprehensive reporting tools that give valuable insights into the firm’s overall financial health. By monitoring metrics such as outstanding balances and average payment times, firms can make informed decisions and adjustments as needed.

Invoicing software can also greatly improve the client experience. By offering a user-friendly interface, electronic invoice delivery, and multiple payment options, clients can easily access and settle their invoices at their convenience. This increased level of professionalism and ease of use can lead to improved client retention and brand perception, ultimately contributing to the continued growth and success of the CPA firm.

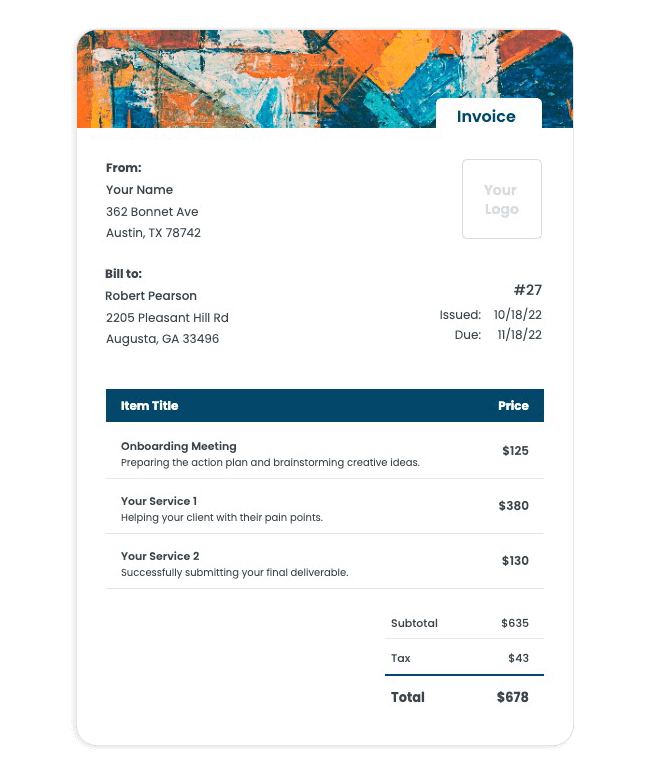

Invoice Templates

Wondering how to craft an invoice that gets your freelancing payments rolling in? With Kosmo, designing eye-catching, professional invoices for your work—even for CPA firms—is a piece of cake.

Simply pick one of our complimentary invoice templates, incorporate your personal brand, and make sure to add all the crucial details like payment conditions and your contact info. Share your invoice digitally and witness quicker payments, thanks to our automatic late payment reminders. Trust me—you’ll wonder how you ever managed without it.

Get paid on time,

every time.

Create professional invoices with Kosmo and level up your business today.

What payment options work with Kosmo?

When using Kosmo, you have the flexibility to choose from a variety of payment options. The platform seamlessly integrates with both Stripe and PayPal, allowing your customers to make payments via credit or debit cards. These integrations aim to facilitate easy and secure transactions for your customers, ensuring their satisfaction.

Additionally, Kosmo allows you to incorporate custom payment methods, tailoring the experience to suit the specific preferences of your user base. This customization feature creates a smoother purchasing process, ultimately contributing to your business’s success. By catering to these diverse payment methods, Kosmo ensures that customers have a positive experience using your platform.

Does this really save time?

Invoicing software significantly streamlines CPA firms’ operations by automating many repetitive tasks and reducing the likelihood of manual errors. Customizable templates and the ability to manage numerous clients in a centralized platform makes the invoicing process much faster and more efficient. In addition, features such as automatic tax calculations, real-time currency conversion, and integration with accounting tools enhance the accuracy of invoicing, thus saving time for CPA firms.

Moreover, invoicing software improves the tracking and management of outstanding payments, all while boosting overall productivity. It offers functionalities such as automated payment reminders, detailed reporting capabilities, and integration with popular payment gateways, which simplify the process of monitoring and collecting client payments. As a result, CPA firms can direct more time and resources toward high-value tasks like advisory services and financial strategy development, ultimately contributing to their success and growth.

Who should use invoicing software?

Invoicing software primarily benefits small business owners, freelancers, and entrepreneurs who need a streamlined solution to handle their billing and payment processes. Such software simplifies invoice creation, management, and tracking, allowing professionals to spend more time focusing on their core business activities. Additionally, invoicing software helps maintain a professional corporate image, as it typically generates well-designed invoices with customizable templates.

Moreover, teams working across industries, from creative and marketing agencies to consulting firms and retail stores, can leverage invoicing software to enhance productivity. These solutions improve collaboration by supporting multiple users and offer features like automated billing, recurring payments, and integrated tax calculations. Ultimately, invoicing software is a valuable tool for anyone seeking a more efficient and organized financial management experience.